The financial industry continues to face pressure from regulators to be compliant with anti-money laundering (AML), know your customer (KYC) and sanctions regulations. The first billion-dollar fine for violation of anti-money laundering regulations was issued in 2001 and has been followed in subsequent years by other record-breaking fines. Changing AML regulations and a shifting political climate has seen major growth in the complexity of sanctions compliance obligations. This growth has been driven by increased civil enforcement actions, new sanctions programs, and guidelines, including the importance of due diligence.

To meet their financial crime compliance obligations, financial services firms have typically utilised commercial software solutions from third-party vendors deployed within their environments. The ongoing operational cost of managing the output of these systems and the teams of AML and Sanctions Analysts required for this is prohibitive.

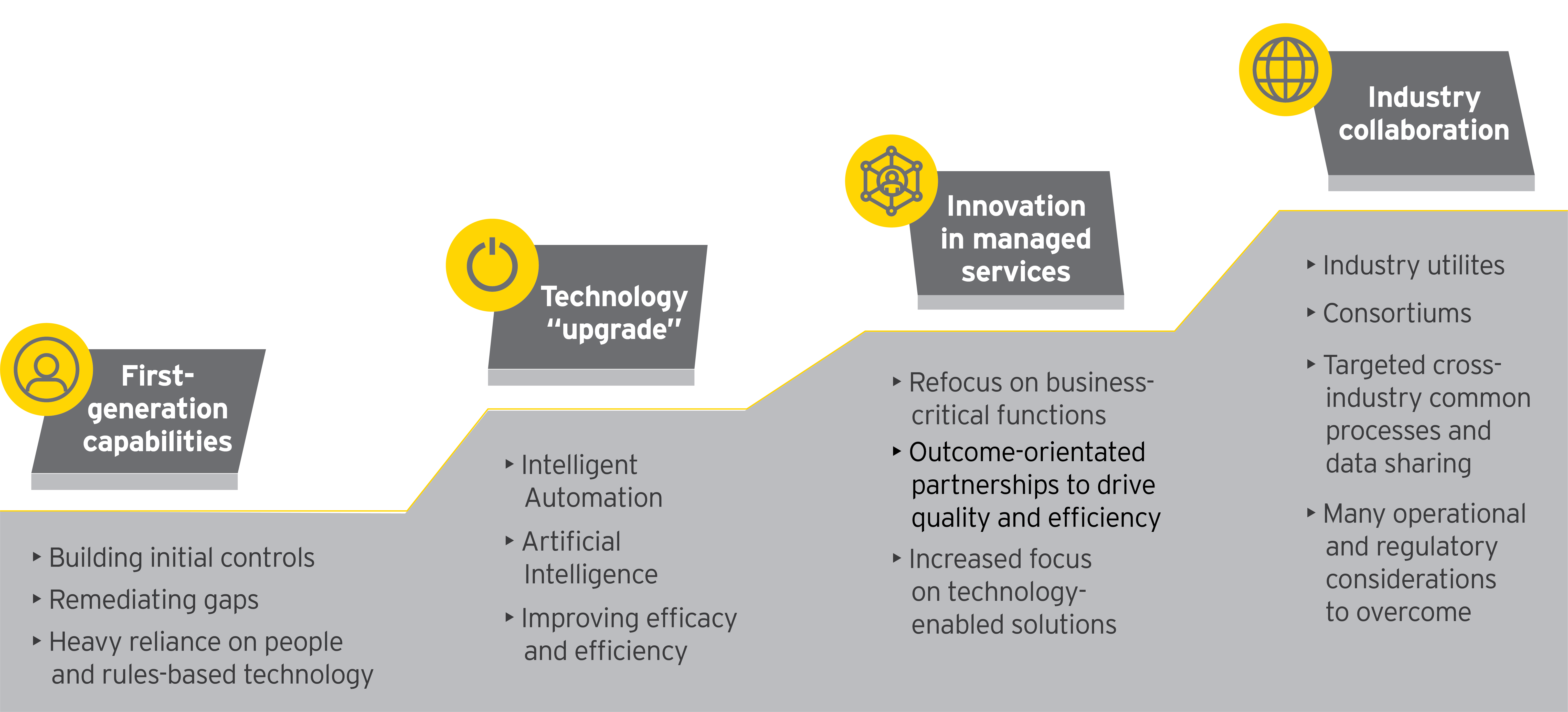

To meet the increasing cost and complexity, firms are looking at several approaches, including new delivery models and leveraging new technologies.

Innovative delivery models

The financial services industry is asking providers to innovate on delivery models, with a focus on outcome-driven partnerships that reduce cost, allow a refocus on core business activities while effectively combatting financial crime.

Financial institutions typically have a combination of third-party vendor platforms to help mitigate their financial crime risks across sanctions and politically exposed persons (PEPs), transaction monitoring and KYC. These platforms are typically deployed in-house, are largely rules-based and may have been deployed tactically to address specific gaps. This has created an industry-wide need for modern technology to be brought to bear to help alleviate the rising costs of financial crime for financial services firms.

In addition, a number of financial services firms are exploring the use of managed services to allow them to both reduce costs and refocus on their core business activities, while effectively managing financial crime risk. The industry is asking providers to innovate on delivery models, with a focus on outcome-driven partnerships.

The rapid growth of new technologies is providing new opportunities to protect against financial crime. Combining innovative new technologies provides an opportunity to drive real disruption in the financial crime domain while reducing costs. These technologies can be leveraged in new and novel ways to improve both the effectiveness and efficiency of first-generation financial crime platforms. Artificial intelligence/machine learning has been leveraged in several ways within the financial crime space to address effectiveness and efficiency problems.

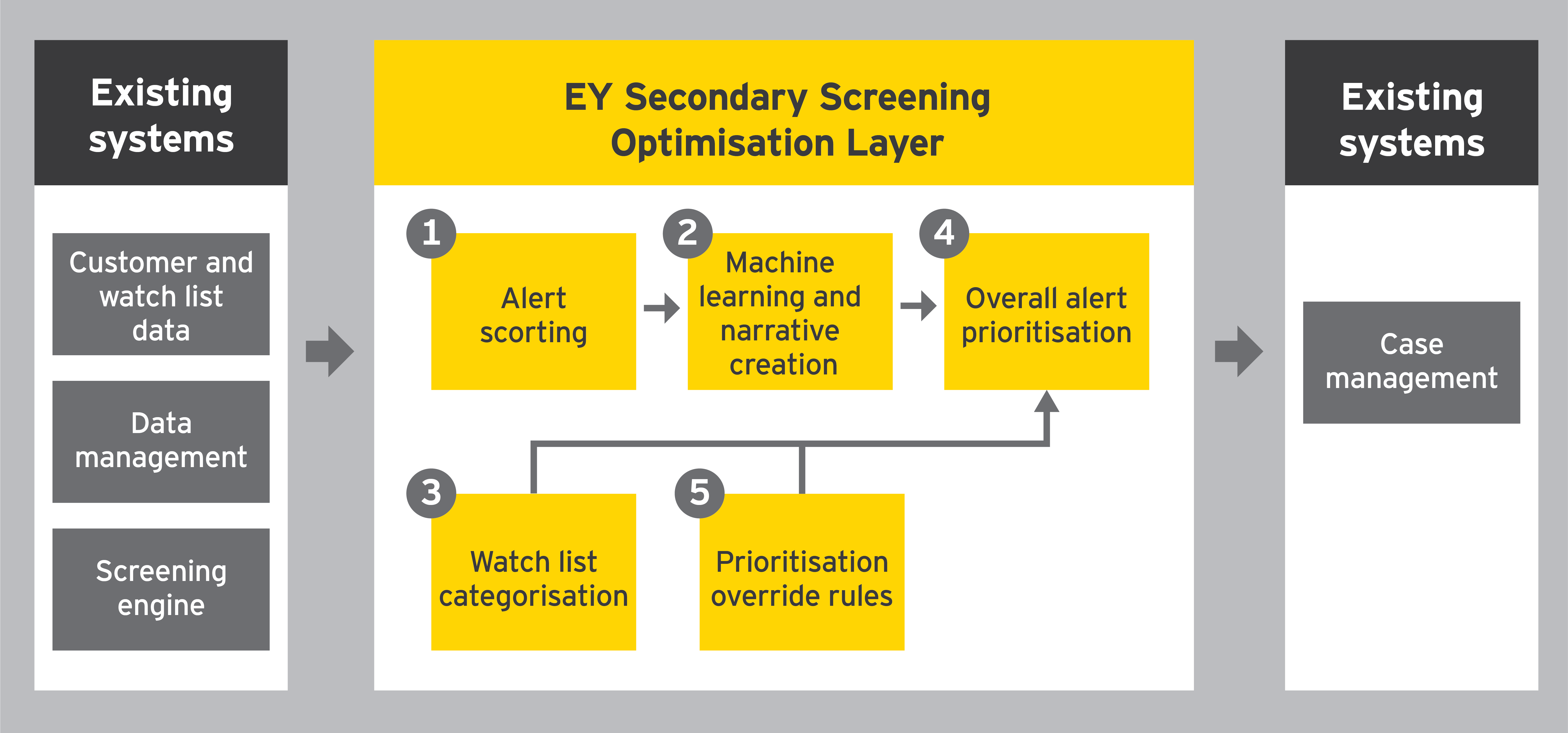

Machine learning

One key area of focus is the use of machine learning to derive insight from previous human performed investigations, enabling machine learning platforms to predict the outcome of alerts produced by existing vendor platforms. This provides an opportunity for significant operational savings, but requires careful monitoring to ensure that models are performing in line with expectation. Organisations should comprehensively articulate where a solution fits into their existing technical architecture, including alterations to data flows, service-level agreements (SLAs) and system owners. Teams should be able to describe all process steps with transparency and simplicity. An example of a machine learning platform that EY has deployed is below.

Robotic Process Automation

Another technology that has seen widespread adoption is Robotic Process Automation. This technology provides a straightforward framework for financial services firms to leverage to automate repetitive, time-consuming manual tasks, such as sourcing data to populate an AML case.

We are working with clients to leverage these new technical capabilities to address financial crime use cases in a number of domains, including AML investigations and transaction monitoring, know your customer, sanctions and PEP screening. As the threats continue to evolve, the financial services industry must also evolve to combat them. Investing in artificial intelligence tools will play an increasingly important part.

If you have any questions about innovations in financial crime, don’t hesitate to get in touch with me or your usual EY contact.